If you have any problem with CCHI insurance check. If yes? You are in a write blog. We hope your all confusion is clear about Cchi insurance in this article. Please read the complete article.

CCHI Insurance Check

Please enter your Identity number then press the “OK” button. After entering your details move to the official website and then again enter your Identity number and see your current status.

Disclaimer: This site is connected to the official website. So, Don’t worry your personal information is saved and secure.

Saudi Arabia requires expatriates and their family members living there to have private health insurance. If you wish to renew your Iqama or apply for a work permit in the KSA, you’ll need proof of insurance.

You can check an Iqama holder’s health insurance status via Absher or the CCHI website. Please follow the steps below.

CCHI Insurance Check Online 2023

The CCHI website can also be used to check the validity of iqama holders’ health insurance policies. Please follow these steps.

Step 1: Visit the official website of CCHI, By Clicking below the button.

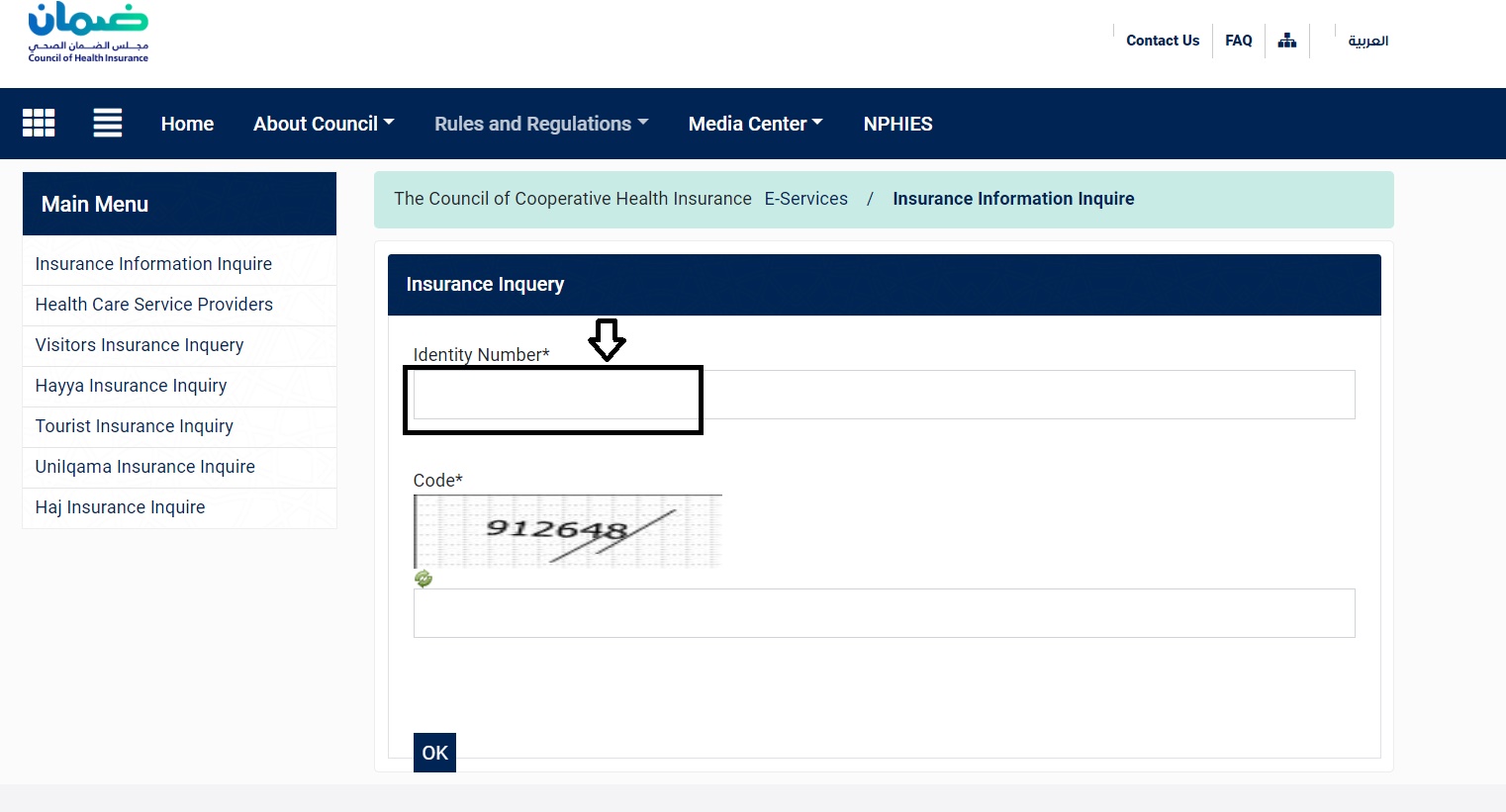

Step 2: Enter your Identity number as we mention in the image.

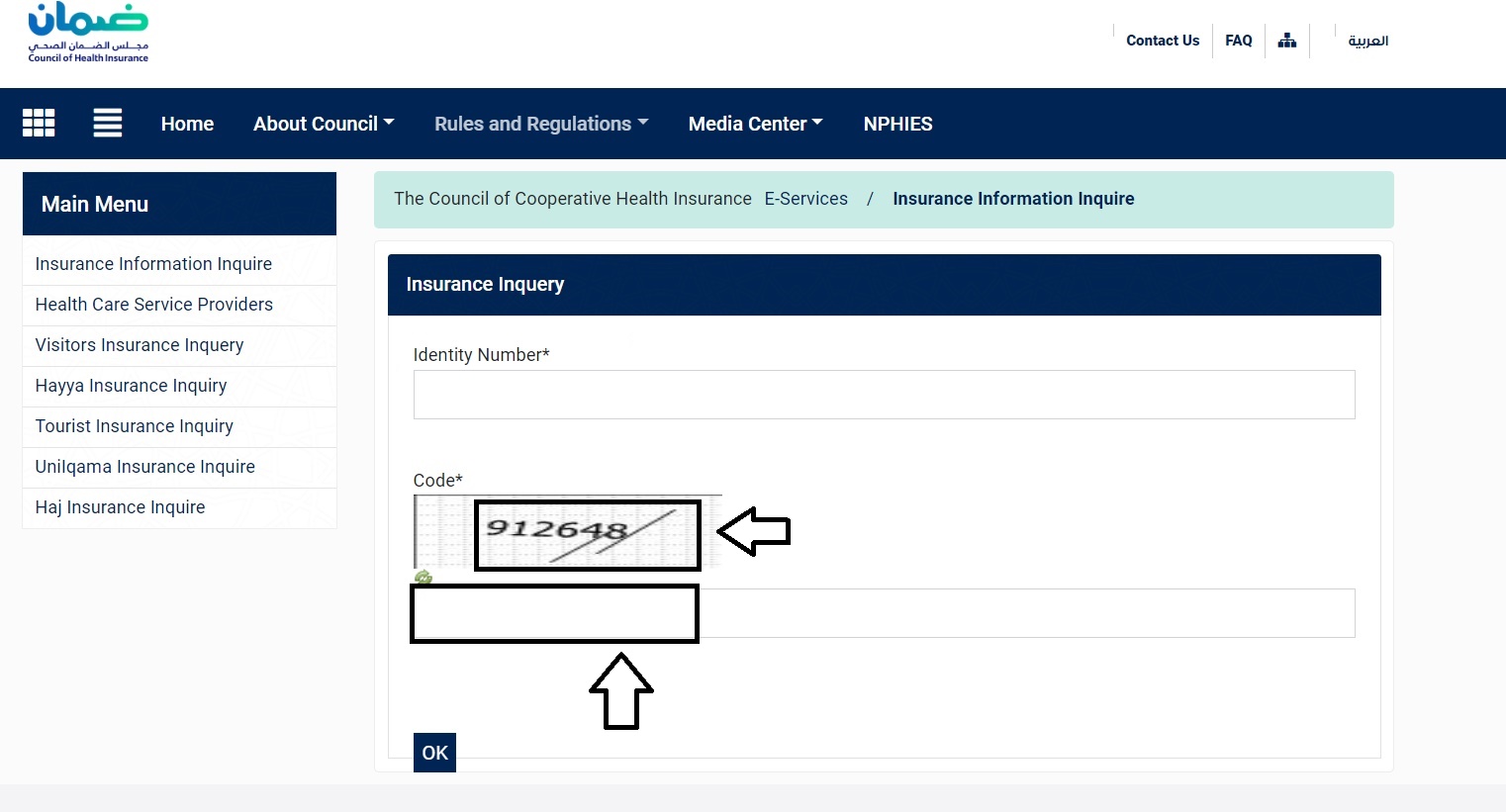

Step 3: Please write the captcha code in the provided captcha box.

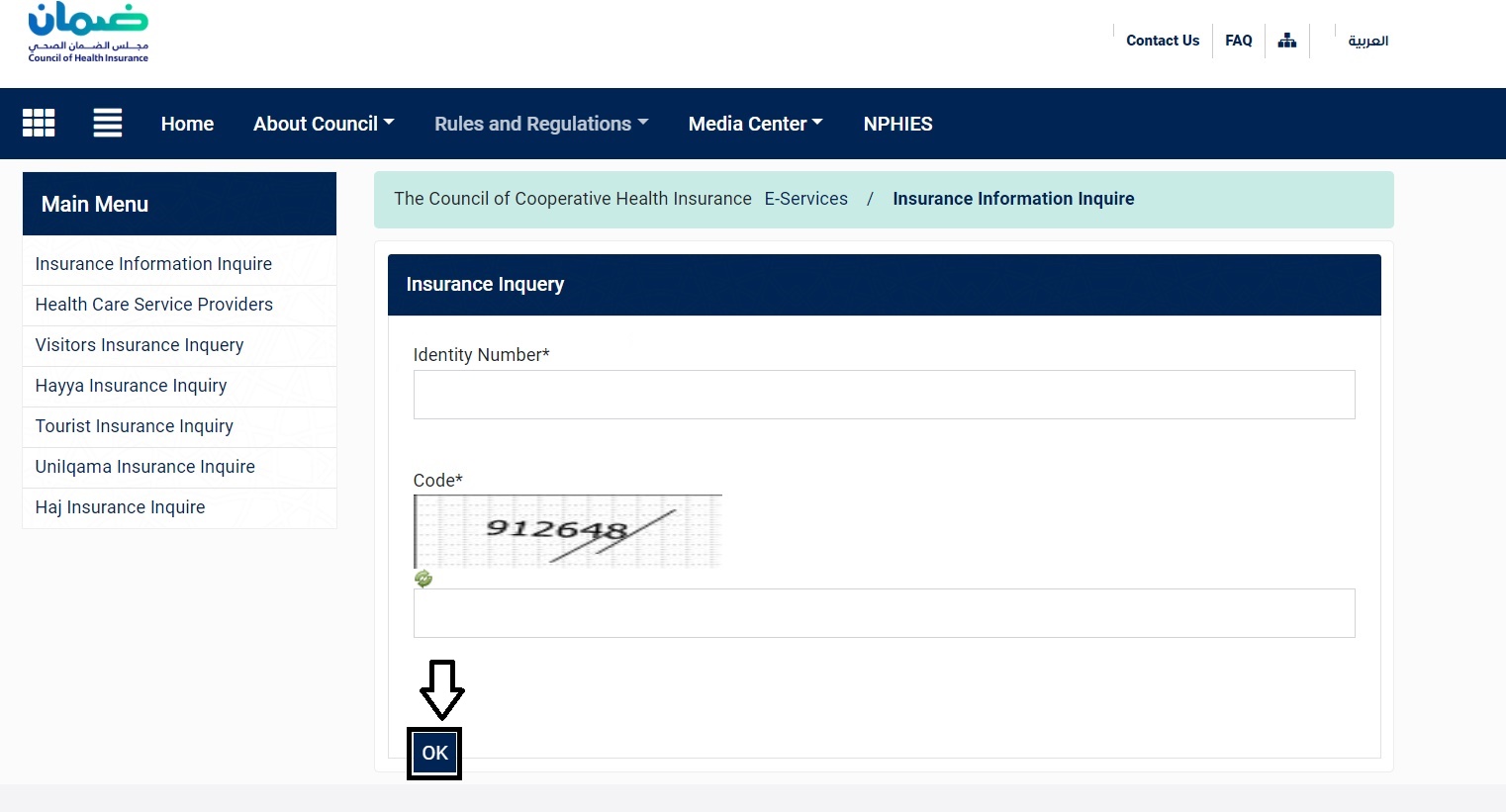

Step 4: Finally Click on the OK button.

Step 5: You will be able to see information about the insurance, including the class, deductible percentage, policy number, beneficiary number, and expiration date on the system.

Health Insurance Check Through Absher

A user can check the expiration date of his or her health insurance through Absher.

- Visit the Official website of Absher

- Log in to the Absher Account.

- Click on “Inquiries” under Family Members.

- Click on “Query Health Insurance“.

- Choose the family member from the dependents list.

- Absher will show you the expiration date of your health insurance.

Iqama Insurance Status Check on the CHI App

You can also check the status of your Iqama health insurance coverage by using the “Daman” CHI app. You can download it from the Google Play Store or the Apple App Store.

- The first step is to download the CHI app.

- Select the English language option.

- Log in using your “Nafath” account details.

- You can now view your insurance information.

Health Insurance Status and Expiry Check Without Iqama Number

The CCHI website also allows expat residents in Saudi Arabia to check their insurance status and expiry date and identify the insurance company without their Iqama number.

If you do not have an Iqama number, you can check the status and expiry date of your Saudi health insurance by following the steps below:

- Visit the website of the Council of Cooperative Health Insurance (CCHI).

- Enter your ‘Border Number’ in the Identity Number section

- Enter the verification code in the image accurately

- Please click on ‘OK‘ to continue.

On the next page, you will see your complete health insurance information, including your class, beneficiary number, policy number, deductible percentage, and expiration date.

CCHI Insurance Check For Visit Visa

The CCHI website also allows you to check the insurance validity of a family visit visa holder.

- Open the CCHI website.

- Enter your passport number in the provided box.

- Please Write the captcha code.

- There will be a display of the name of the health insurance company, the type of health insurance, the issue date, and the validity status of the health insurance of the holder of the visit visa.

CCHI Insurance Check Methods

CCHI Online Portal

The CCHI offers policyholders convenient access to their insurance information via an online portal. Visit the CCHI website and navigate to the appropriate section for insurance verification. Please enter your policy details or national identification number so that we can retrieve your insurance information. The portal will display information about the insurance provider and policy validity.

Mobile Applications

CCHI insurance details can be accessed through mobile applications developed by insurance companies and third-party developers. A user-friendly interface allows you to view policy details, coverage, and other related information using your policy information or national ID.

Contact Your Insurance Provider

Direct contact with your insurance provider is an option if you prefer a more direct approach. They will have access to your policy information and can assist you in verifying it. Contact them with your policy number or national ID handy to make the process as smooth as possible.

What is CCHI?

Saudi Arabia’s Council of Cooperative Health Insurance (CCHI) oversees health insurance operations. A primary objective of the organization is to protect the rights of policyholders and to provide quality healthcare services. Regulating insurance policies and enforcing industry standards is the responsibility of CCHI in collaboration with insurance companies, healthcare providers, and other relevant stakeholders.

Importance of CCHI Insurance Check

CCHI insurance checks allow policyholders to stay informed about their health insurance coverage. Verifying the status of your policy allows you to make sure you are receiving the benefits and services you are entitled to. The process also allows you to identify any discrepancies or errors in your insurance records, allowing you to resolve them as soon as possible.

How to Apply For CCHI Insurance

The process for applying for Cooperative Health Insurance (CCHI) in Saudi Arabia may have changed or evolved, so it’s important to check the latest guidelines on the official CCHI website or contact their customer service for the most up-to-date information. However, I can provide you with a general idea of how the process typically works:

Eligibility and Requirements

Ensure that you meet the eligibility criteria for CCHI. Typically, all residents in Saudi Arabia are required to have health insurance, and it’s usually provided by their employers, but if not, you might need to apply for individual coverage.

Gather Necessary Documents

You’ll usually need the following documents and information:

- A valid Saudi Arabian residency permit (Iqama).

- Passport copy.

- Contact information (phone number, address, email).

- Any other documents specified by CCHI.

Visit the CCHI Website

- Go to the official CCHI website. The website address may have changed, so perform an online search to find the current website.

- Look for an online registration or application portal.

Create an Account

You may need to create an online account if you don’t already have one. This typically involves providing your personal information.

Complete the Application

- Log in to your account and fill out the online application form with your personal and contact information.

- Upload the required documents.

Pay the Premium

Depending on your situation, you may be required to pay the insurance premium. This can typically be done online through various payment methods, such as credit/debit cards or bank transfers.

Review and Submit

- Carefully review all the information you’ve entered and the documents you’ve uploaded.

- Submit your application.

Confirmation and Documentation

- You should receive a confirmation of your application submission.

- CCHI will review your application, and if approved, they will issue your health insurance card and send you the necessary documentation.

Activate Your Health Insurance

Once your application is approved, you should be able to use your health insurance for medical services.

CCHI Insurance Eligibility

Insurance eligibility can vary widely depending on the type of insurance you are referring to, such as health insurance, car insurance, or any other form of coverage.

To determine your eligibility for a specific insurance program, you should contact the insurance provider directly or visit their website. They will provide you with the eligibility criteria, application process, and any other relevant information.

If “CCHI” represents something different or specific in your context, please provide more details, and I’ll do my best to assist you further.

CCHI Insurance Requirments

The Cooperative Health Insurance (CCHI) program in Saudi Arabia mandates that all employers in the private sector provide health insurance coverage to their employees and their dependents. The requirements for CCHI insurance in Saudi Arabia may have evolved since then, so it’s essential to consult official sources or insurance providers for the most up-to-date information. However, here are the general requirements and key points associated with CCHI insurance as of 2023:

Employer Responsibility: Employers in the private sector are responsible for providing health insurance coverage to their employees and their dependents, including spouses and children.

Mandatory Coverage: The CCHI program mandates that certain categories of employees, such as expatriates, domestic workers, and some other non-Saudi workers, must be covered by health insurance. Saudi citizens are also typically covered by government healthcare programs.

Basic Coverage: The insurance coverage should include basic medical services, including doctor’s visits, hospital stays, surgeries, and essential medications.

Premium Payment: Employers are generally required to pay the insurance premiums for their employees and their dependents. However, there may be provisions for cost-sharing between employers and employees in certain cases.

Insurance Providers: Employers can choose from approved insurance providers to provide coverage to their employees. These providers are regulated and authorized by the CCHI.

Waiting Period: There may be a waiting period for new employees before they can access healthcare services. This waiting period varies depending on the specific insurance policy.

Documentation: Employers must maintain records and documentation related to their employees’ insurance coverage and ensure that employees receive the necessary insurance cards.

Penalties: Failure to provide CCHI insurance to eligible employees can result in penalties and legal consequences for employers.

Eligibility: The eligibility criteria and requirements for CCHI insurance may vary for different categories of employees. Expatriates, for example, typically need to meet specific criteria to be eligible for coverage.

Benefits of Regular Insurance Check

CCHI insurance checks offer several benefits:

Policy Verification

You can confirm that your policy is active and valid, ensuring uninterrupted coverage.

Coverage Review

By reviewing your insurance details, you can find out what benefits, coverage limits, and services your policy covers. Making informed healthcare decisions is easier when you have this knowledge.

Preventing Unauthorized Use

By regularly checking your policy, you can identify fraudulent activities, such as someone else using your policy without your permission. Detecting such issues early can protect you from potential financial pitfalls.

Billing and Claims Accuracy

The accuracy of your billing and claims processes can be ensured by verifying your insurance details. You can contact your insurance provider if you notice any discrepancies.

Check insurance policy

There is no widely recognized or standard insurance policy known as a “CCHI insurance policy.” Insurance policies often have specific names and coverages associated with them, and these names can vary by region and insurer. It’s possible that a specific insurance product with the acronym CCHI has been introduced since my last update, or it could be a less common or specialized insurance policy.

If CCHI stands for something specific in a particular context, it’s important to understand the context and the organization or company that is offering this insurance. I recommend checking with the relevant insurance provider or referring to their documentation or website to learn more about what a “CCHI insurance policy” might entail, or consider contacting a local insurance expert for clarification if it’s a regional or specialized product.

CCHI Insurance Contact Detail

You can also contact CCHI Insurance. Here are the complete details of CCHI Contacts.

- Unified Number: 920001177

- Email: [email protected]

- CHI Mobile App: https://play.google.com/store/apps/details?id=co.ntime.cchi_majlis&hl=en&gl=US

- Youtube

Read Also

- Health Insurance Work in Saudi Arabia

- Insurance For Saudi Tourist Visa

- Check Medical Insurance For Visit Visa

- Check Iqama Health Insurance

- CCHI Insurance Contact Detail

- Iqama Renewal Check

- Iqama Expiry Date Check 2023

- Iqama KSA Check 2023

- Iqama Medical Check

- Iqama Fees Structure

- Iqama Number Explain in Detail

- Iqama Huroob Status Check Online 2023

FAQs About CCHI Insurance Check

Q1) How to check insurance in cchi?

Ans:- The CCHI website can also be used to check the validity of iqama holders’ health insurance policies. Please follow these steps.

- Visit the official website of CCHI,

- Enter your Identity number as we mention in an image

- please write the captcha code in the provided captcha box.

- Finally, Click on the OK button.

- You will be able to see information about the insurance, including the class, deductible percentage, policy number, beneficiary number, and expiration date on the system.

Q2) How to check medical insurance for visit visa?

Ans:- Here are the steps to check medical insurance for visit visa

- Visit the CCHI website.

- Select the insurance inquiry option.

- Go to the service button.

- Enter the passport number used to issue the insurance policy.

- Please enter the verification code on the image and click (Submit).

- After that, you will be able to see the results.

Q3) What is the full form of Chi insurance?

- Go to the CCHI website.

- Select the inquiry about insurance services.

- Press the Go service button.

- Enter the passport number used to issue the insurance policy.

- Enter the verification code on the image and click (Submit).

- After that, you will be able to see the results.

Q5) How to check insurance validity in cchi

Ans:- Follow these steps to check the status and expiry date of your Saudi health insurance without an Iqama number:

- Visit the website of the Council of Cooperative Health Insurance (CCHI).

- Your ‘Border Number’ should be entered under ‘Identity Number’

- Please enter the verification code accurately on the image

- Click ‘OK’ to continue.

Conclusion

We hope all confusion is clear about the CCHI Insurance Check. If you have any problem checking your health insurance status, Please comment in the comment section.

Regular CCHI insurance checks in Saudi Arabia are vital for expatriates, ensuring healthcare access, policy verification, and protection against unauthorized use. Stay informed for reliable coverage.